How to Secure Vending Machine Financing: Tips for 2025 Entrepreneurs

In the competitive world of 2025, entrepreneurs are exploring vending machine financing as a viable business opportunity. Research indicates that the vending machine industry is projected to reach $25 billion by 2025, with growth driven by technological advancements. According to industry expert Mark Thompson, "Investing in vending machines requires careful planning and the right financing to thrive."

Navigating the nuances of vending machine financing can be challenging. Many entrepreneurs overlook vital aspects, such as location selection and machine stocking. The risk of poor financial planning also poses significant challenges. Statistics reveal that nearly 30% of new vending businesses fail within their first two years.

To succeed, comprehensive knowledge of vending machine financing is essential. Many entrepreneurs will need financial support to cover initial costs, including machine purchases and maintenance. Choosing the right financing option can determine success or failure in this industry. Entrepreneurs must reflect on their strategies and anticipate potential pitfalls.

Understanding Vending Machine Financing Options for Entrepreneurs

Understanding the various vending machine financing options is essential for aspiring entrepreneurs. Traditional banks offer loans, but the approval process can be lengthy. Many applicants find themselves waiting weeks, only to face rejection. Exploring alternative financing methods can save time and stress. Peer-to-peer lending is gaining popularity; it connects entrepreneurs with individual investors. This option can often yield faster results.

Another route is equipment financing. This allows you to use the vending machines while paying. The machines themselves serve as collateral. However, interest rates can vary significantly. You'll need to shop around for the best deal. Some may choose to finance through personal savings. This can be a double-edged sword; it reduces debt but also risks personal funds.

Consider also the importance of a solid business plan. It often includes projected earnings and detailed location analysis. Many lenders require this information before they decide. Skipping this step may result in lost opportunities. Lastly, entrepreneurs should evaluate their own financial health. A strong credit score can greatly enhance financing approval chances. Reflecting on all these factors may take time, but it can provide better outcomes in the long run.

Vending Machine Financing Options for Entrepreneurs

Assessing Your Business Plan for Vending Machine Investments

Assessing your business plan is crucial for vending machine investments. A solid plan outlines your target market and potential locations. Conduct thorough research on foot traffic and competitors. These insights help you decide where to place your machines. Take time to explore your unique selling points. What sets your vending machines apart?

Tips: Focus on your budget. Don't underestimate operational costs. Consider maintenance, location rent, and product restocking. Keep track of your expenses. This will give you a clearer picture of profitability. Understand your financial needs for growth. Will you want more machines in the future?

Additionally, refine your marketing strategy. How will you attract customers? Use social media to promote specials or new products. Engage with your community. Listen to feedback and adjust accordingly. A flexible approach can significantly impact your success. Reflect on your strategies regularly. What’s working? What needs improvement? Adjust your plan as needed.

Exploring Loan Requirements and Qualifications for Vending Machines

When seeking financing for vending machines, understanding loan requirements is crucial. Most lenders look for a credit score of at least 600. However, some may accept lower scores with strong business plans. Reports indicate that 80% of vending machine businesses are self-financed. This highlights the importance of having satisfactory funds to support your venture.

Beware, however, that lenders also evaluate your business history. A track record of management can increase your chances. Having clear financial projections is essential. Professionals argue that clear, concrete presentations attract lenders.

Tips for financing include keeping your business plan detailed. Consider including potential locations and customer demographics. Your plan should project realistic income, costs, and profits. Ensure your financial documents are ready, too. Lenders often take time assessing these papers. Finally, lead with confidence in your discussions. You need to show you're serious. Often, passion sways decisions more than you think.

How to Secure Vending Machine Financing: Tips for 2025 Entrepreneurs

| Criteria | Details |

|---|---|

| Credit Score | Minimum 650 preferred |

| Loan Amount | $5,000 to $100,000 |

| Interest Rates | 4% to 10% APR |

| Loan Terms | 3 to 7 years |

| Collateral | Vending machines and inventory |

| Application Process | Online application, financial statements, business plan |

| Business Plan | Include marketing strategies, target market, and financial projections |

| Additional Considerations | Location type and foot traffic analysis |

Identifying Potential Lenders and Financing Resources in 2025

Securing financing for vending machines in 2025 requires careful planning. First, identify potential lenders who understand the industry. Many entrepreneurs overlook local banks and credit unions. These institutions often have tailored programs for small businesses. According to a recent report from the National Association of Vending, over 40% of operators financed their machines through community banks. Their personalized service can help you navigate complex lending processes.

Consider alternative financing options. Crowdfunding platforms are gaining traction. They allow you to raise small amounts from many investors. The same report notes that 25% of vending machine operators used crowdfunding in the last year. This method can also test your product's market viability. However, building a convincing campaign takes effort and clear communication.

Finally, assess potential risks associated with each financing option. High-interest loans can lead to significant challenges later. If a lender doesn't fully understand your needs, it can result in unfavorable terms. Research is key here. Analyze your cash flow projections before making a decision. This detailed approach can enhance your chances of securing optimal financing for your vending business in 2025.

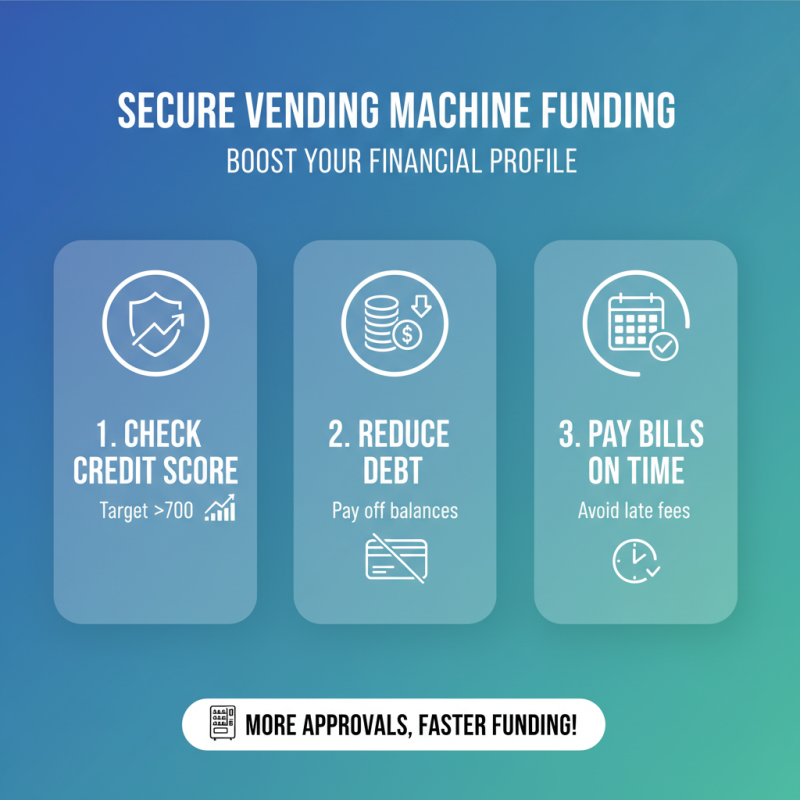

Enhancing Your Financial Profile to Secure Vending Machine Funding

Enhancing your financial profile is crucial for securing vending machine funding. Start by reviewing your credit score. A strong score can increase your chances with lenders. Aim for a score above 700. If it’s lower, take steps to improve it. Pay down existing debts and ensure all bills are paid on time.

Next, gather relevant financial documents. Prepare tax returns, bank statements, and income proof. Having these ready shows lenders you are organized. It might be beneficial to develop a detailed business plan as well. It demonstrates your commitment and outlines your strategy for profitability.

Consider diversifying your income sources too. This can alleviate some risks for lenders. Also, reflect on your past mistakes. Were there missed payments or unwise investments? Acknowledging these can help you avoid similar pitfalls in the future. Remember, a proactive and honest approach to your finances will bolster your chances of securing that essential funding.

Related Posts

-

Exploring Vending Machine Financing Opportunities at China’s 138th Import and Export Fair 2025

-

Best 7 Vending Machine Financing Options for Small Business Owners in 2023

-

What is a Car Reader and How Does It Work in Vehicle Diagnostics

-

7 Essential Tips for Choosing Your Perfect Drink Machines

-

The Rise of Frozen Vending Machines in 2025 What You Need to Know

-

What is a Food Vending Machine? Insights and Industry Growth Projections for 2023