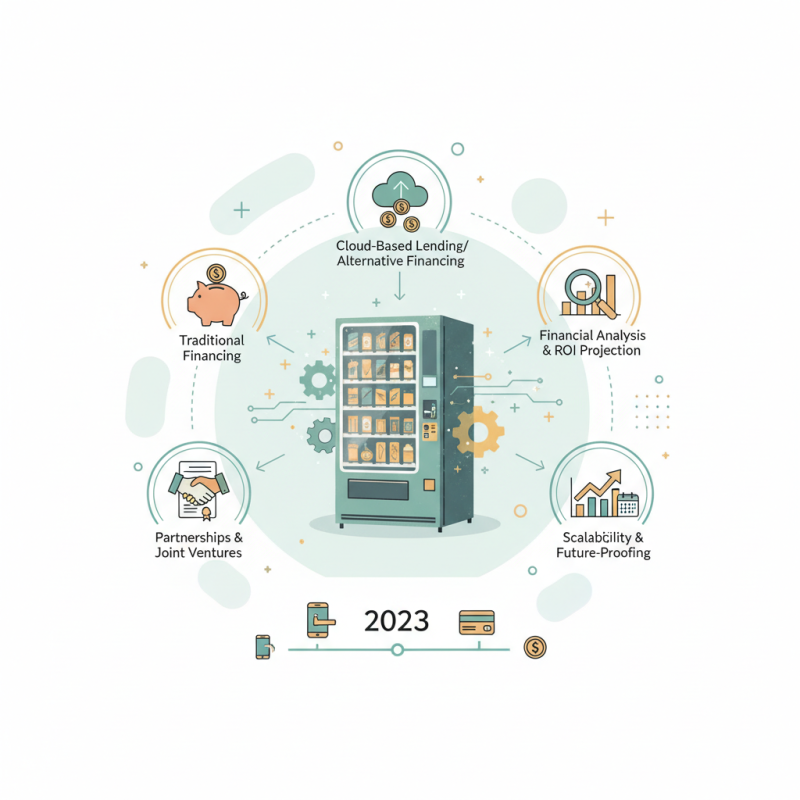

5 Essential Tips for Successful Vending Machine Financing in 2023

In the evolving landscape of vending machine financing, entrepreneurs and investors alike are seeking innovative ways to maximize their return on investment. As Robert Kane, a recognized expert in vending operations and financing strategies, aptly puts it, “Understanding the financing landscape is crucial for anyone looking to thrive in the vending industry.” This statement underscores the importance of informed decision-making when navigating the complexities of securing funding for vending machines.

The year 2023 brings both challenges and opportunities for those involved in the vending machine sector. With advancements in technology and consumer preferences shifting, financing has become an essential aspect of setting up a successful vending business. Entrepreneurs must not only be aware of traditional financing options but also explore alternative methods that can offer flexibility and scalability.

In this guide, we will delve into five essential tips that will empower you in your vending machine financing journey. Whether you are a seasoned operator or just starting, understanding these strategies can provide you with a solid foundation for achieving success in this dynamic market. Together, let’s unlock the potential of vending machine financing and pave the way for a thriving future in this industry.

Understanding Vending Machine Financing Options in 2023

When exploring vending machine financing options in 2023, it's essential to consider various pathways that could align with your business goals. Traditional loans from banks or credit unions remain a viable choice, providing a straightforward way to secure capital for your vending machine business. However, the lending criteria can be stringent, making it essential to have a solid business plan in place. Additionally, some lenders may require a detailed financial history, so being prepared with your records is crucial.

Alternative financing options, such as equipment financing or leasing, have grown increasingly popular among vending machine entrepreneurs. With equipment financing, you can use the machines themselves as collateral, which lowers the risk for lenders and can result in more favorable loan terms. Leasing, on the other hand, allows you to utilize machines without the full upfront cost, while still giving you flexibility to upgrade or change equipment over time.

In navigating these options, consider these tips for successful vending machine financing: First, assess your budget precisely to avoid overextending financially. Second, research and compare different financing options thoroughly to find terms that suit your cash flow. Lastly, keep an open line of communication with your financial advisor to help guide you through the decision-making process, ensuring that you choose the best path for your vending venture in 2023.

Evaluating Your Business Needs for Vending Machine Investment

When considering vending machine investment, it's essential to first evaluate your specific business needs. According to a recent study by IBISWorld, the vending machine industry has been growing steadily, with a projected annual growth rate of 1.7% over the next five years. Understanding your target market and location can significantly influence the success of your vending machine investment. For instance, high-traffic locations such as schools, hospitals, and office buildings can yield higher revenue, making it crucial to assess where demand is strongest for your offerings.

Furthermore, it’s important to analyze your initial budget and funding options. The average cost to purchase and set up a vending machine can range from $3,000 to $10,000, depending on the machine type and product variety. Financing can often come from business loans or leasing options, which can alleviate upfront costs. According to a report by Statista, nearly 23% of vending machine operators use financing services to manage their cash flow effectively. Carefully weighing these financial aspects against projected income streams will help align your investment with your overall business strategy, ensuring that your vending machine venture thrives in 2023 and beyond.

5 Essential Tips for Successful Vending Machine Financing in 2023

| Tip | Description | Key Considerations | Potential Costs |

|---|---|---|---|

| Assess Your Needs | Evaluate the types of products you want to sell and the volume of sales. | Market demand, product selection, location suitability. | $500 - $1,500 |

| Choose Financing Options | Explore loans, leases, and alternative financing to find the best option for your situation. | Interest rates, repayment terms, and fees. | $200 - $1,000 |

| Understand Your Budget | Create a comprehensive budget that includes purchase, operation, and maintenance costs. | Operational costs, unexpected expenses. | $1,000 - $5,000 |

| Evaluate Locations | Identify high-traffic areas to maximize your machine's exposure and sales. | Foot traffic, competition, lease agreements. | $300 - $2,000 |

| Review Performance Regularly | Regularly analyze sales data to adapt your strategy and product offerings. | Sales trends, customer feedback, inventory management. | $100 - $500 |

Essential Steps to Create a Strong Financing Proposal

When crafting a robust financing proposal for a vending machine business, clarity and detail are paramount. Start by clearly outlining your business plan, which should include an analysis of your target market, location choices, and the types of products you intend to sell. Demonstrating thorough research into potential revenue streams and customer demographics not only showcases your preparedness but also instills confidence in potential lenders regarding your business's viability.

Next, include a detailed financial projection that outlines anticipated expenses and revenue over the first few years. This projection should account for the initial costs of purchasing vending machines, product inventory, and maintenance fees. Additionally, highlight how much capital you need and how it will be allocated. Providing a clear exit strategy or plan for profitability will further enhance your proposal, illustrating a thoughtful approach to achieving financial success in the vending machine industry. By presenting this information concisely and confidently, you will create a strong case that resonates with potential financiers.

Sales Performance of Vending Machines by Type in 2023

Exploring Lenders and Financing Platforms for Vending Machines

When considering financing options for vending machines in 2023, it's crucial to explore various lenders and financing platforms tailored specifically for this niche market. According to a recent industry report, the vending machine market is projected to grow at a compound annual growth rate (CAGR) of 3.4% through 2027, emphasizing the increasing opportunity for investors in this sector. With such growth, securing adequate financing can make a significant impact on your business success.

Traditional banks often have stringent requirements that can be challenging for vending machine operators to meet. Instead, many are turning to alternative financing platforms which provide more accessible options. Peer-to-peer lending and online financing platforms have gained popularity, offering swift approval processes and flexible repayment terms. In fact, data indicates that small business loans from alternative lenders can offer funding within 24 hours, allowing entrepreneurs to seize immediate opportunities. By exploring these diverse financing options, operators can enhance their chances of launching successful vending machine ventures in today's competitive landscape.

Tips for Managing Your Vending Machine Business Finances

Managing your vending machine business finances effectively is crucial for long-term success. One of the first steps is to keep accurate records of income and expenses. Utilize accounting software or a simple spreadsheet to track your daily sales, maintenance costs, and supply purchases. This visibility allows you to identify trends, helping you pivot quickly if a particular machine or product isn’t performing as expected.

Additionally, it’s essential to budget wisely. Set aside a portion of your earnings for unexpected repairs and restocking needs. Consider implementing a cash reserve for emergencies or fluctuations in sales, which can arise due to seasonal changes or economic factors. Proper budgeting not only prepares you for the unexpected but also helps in making informed decisions about future investments or expansions in your vending machine business.

Lastly, regularly review your financial statements to assess profitability. This involves analyzing your cash flow and adjusting your business strategies accordingly. Assess which machines are generating the most revenue and consider whether you should reinvest in higher-performing products or locations based on your findings. By staying proactive with these financial practices, you can ensure your vending machine business remains on solid ground in 2023.

Related Posts

-

7 Tips to Optimize Your Card Reader for Vending Machine Success

-

10 Best IT Vending Machines Transforming Workspaces in 2023

-

Exploring Vending Machine Financing Opportunities at China’s 138th Import and Export Fair 2025

-

Exploring the Future of Automotive Innovation: Car Reader Technologies at the 138th Canton Fair 2025

-

Discovering the Benefits of IT Vending Machines for Modern Workspaces

-

How to Choose the Best Car Reader for Your Vehicle Needs